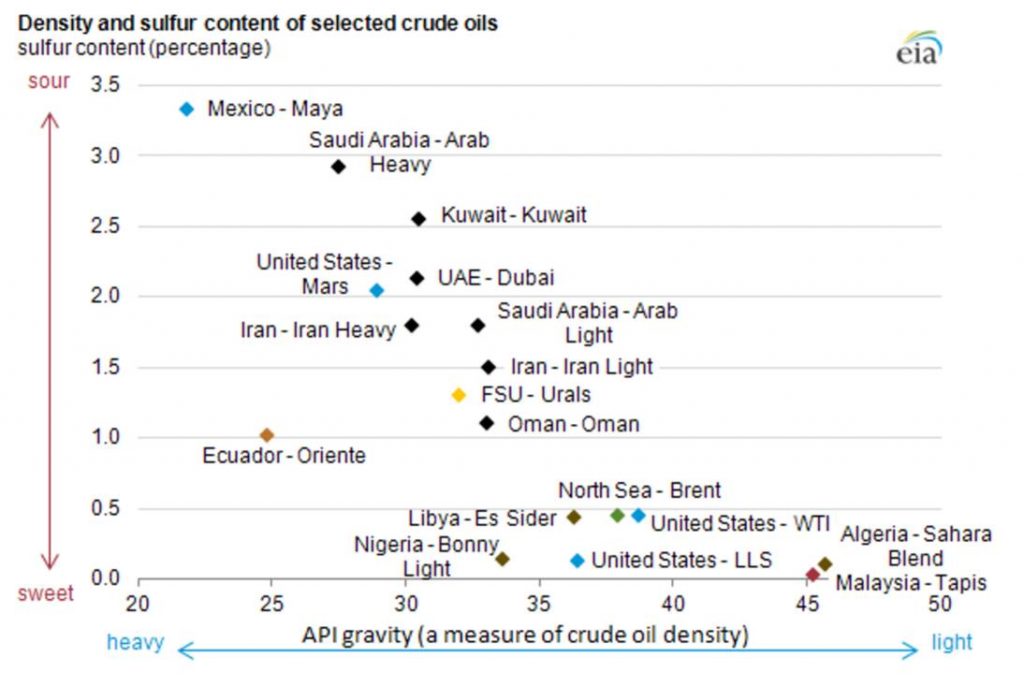

The difference between sweet crude and sour crude

The term sour crude refers to any crude with sulphur content such that require special removal treatment. Although the term sour is defined in ISO 15156 / NACE MR0175 in basis of the H₂S (hydrogen sulphide) partial pressure in the production environment; however for practical terms any crude with more than 0.5% sulphur is consider sour and will require sulphur removal.

Sour crude is also associated to heavier crude as opposed to light sweet crude (with sulphur content below 0.5%. Light sweet crude is traditionally consider more expensive than heavier sour crude, this is because light sweet crude requires less processing and produces a slate of products with a greater percentage of value-added products, such as gasoline, diesel, and aviation fuel. Heavy sour crude was consider to be sold at lower prices than lighter sweeter grades because it produces a greater percentage of lower value-added products with simple distillation and requires additional processing to produce lighter products.

Conventional premiums for light sweet crude were the result of specific circumstances:

(1) strong demand for gasoline rather than diesel;

(2) limited refinery capacity to process heavier molecules;

(3) limited capacity to strip sulphur from feedstock;

(4) limited supplies of light sweet crude compared with abundant supplies of heavier and more sulphurous oils.

Each of these factors has now shifted substantially. The market for light sweet oils is now increasingly oversupplied, while heavy sour grades are seeing stronger demand. Conventional premiums for light sweet crude have eroded, and in some cases light crude are even trading at a discount.

The price adjustment will continue until it makes sense for Asia’s complex refineries to start buying light sweet crudes and forego the technological advantage of utilising their cokers and desulphurisation units fully.

It is already changing the balance of power among oil producers. Countries that produce heavier higher-sulphur crudes like Saudi Arabia and Iraq are the main winners, while countries like Nigeria and Libya with abundant light low sulphur supplies that compete directly with U.S. shale oil may lose out

Sources:

U.S. Energy Information Administration, based on Energy Intelligence Group—International Crude Oil Market Handbook

https://bit.ly/1oJqUZg